Top 7 UK Student Bank Accounts – September 2019

12/09/19 Reference this

Are you struggling to find out which student bank account to open? Does it all look a bit confusing?

We all like to stick within our comfort zone. I know staying with the bank you already have is the easiest option but what’s the harm in looking at other options? I wish I’d shopped around!

The student bank accounts are ranked from top to bottom starting with the best first. Now, of course the best incentives are completely subjective, but this is a good guide to get you started. The accounts are ranked based on overdraft value, incentive value, my favourite incentive options plus any extras.

| Bank | Overdraft | Incentive | Extras |

| Santander | You can get a fee-free overdraft of up to £1,500 during your course. If you say for 5 years this increases to £2,000. | 4-Year 16-25 Railcard | |

| Lloyds | You could be given a fee-free overdraft of £1,500 in years 1-3 and this can increase to £2,000 for years 4-6. | 3-Year TOTUM card | You can choose to activate “It’s On Us”. This enters you into a monthly draw where you can win back the cost of a recent purchase. |

| Royal Bank of Scotland and NatWest | Student account holders can receive an interest-free overdraft of up to £2,000. | You have the option of; a 4-Year Tastecard Plus OR 1-Year Amazon Prime Student Membership OR 4-Year National Express Coachcard | |

| HSBC | You may be able to receive up to £3,000 interest-free overdraft. | You’ll be given £100 just for opening the account. | You can opt for the free 12-Month free British Cycling Fan membership which gives you access to cycling events and discounts in selected stores. |

| Barclays | Student accounts holders could get a fee-free overdraft of up to £3,000. | 3 free e-textbooks when you open your account in your first year. | |

| Nationwide | You can get an interest-free overdraft of up to £3,000. | ||

| Halifax | You could be given a free-free overdraft of £1,500 during your course, plus an extra year after you graduate. Maximum 6 years. | ||

| TSB | You may be able to receive a fee-free overdraft of up to £1,510. |

What does this mean?

You’ll notice I didn’t put the largest overdrafts at top working down to the smallest at the bottom. This is because a higher the overdraft doesn’t mean a better bank account for example, some overdrafts are subject to credit checks so if your credit isn’t great, they aren’t obliged to offer you the full amount. This table is based on a combination of all the factors and which I think I could make the most out of.

1. Santander Student Bank Account

Santander doesn’t have the highest value overdraft but it’s still a good amount. This one is ranked number 1 because I absolutely love the 4-year railcard because it can save you a 1/3 off travel. When I was at university, I would be travelling between there and home all the time. Travelling via train can get pretty pricey so this could save you a whole lot of money, depending on how far and often you travel. Though with train costs these days, you’ll be saving huge amounts in no time at all.

2. Lloyds Student Bank Account

Lloyds comes in at second offering a similar overdraft to Santander along with a 3-year TOTUM card. The TOTUM card replaces the classic NUS card which is full of discounts galore. The value of this card is only £32 but the savings are great. Lloyds also allows you to activate their “Its On Us” which enters you in a draw to win back the value of a recent purchase so… spend big, win big. Right?

3. RBS and NatWest Student Bank Accounts

Royal Bank of Scotland and NatWest offer the same overdraft and perks as each other so they come in at a tie. The perks aren’t bad, but the values aren’t as good. With the value of these overdraft, you can get better perk options going with another account. If you travel by coach often then this could be a great option for you but if you’re like me and your hometown is literally in the middle of nowhere then it isn’t worth it. On the other hand, if you live in the city and want to travel cheaply then this is a contender. Amazon Prime is great, especially for those lazy student days where you promised yourself last night you absolutely will go to that 9am lecture this time… but here you are again eating leftover pizza in your pjs at 10am. The only thing is, you can get a free 6-month Amazon Prime membership anyway directly from Amazon, though this perk is for a longer period. If you are a foodie and go out for dinner often then a free Tastecard is great but a lot of the deals do have some restrictions i.e. not valid on Friday’s or Saturday’s, so you’ll have to decide whether this perk works for you and your free time.

4. HSBC Student Bank Account

HSBC could give you a huge £3,000 overdraft if you’re eligible but don’t get distracted by the big number, you’ll be paying this back one day and banks usually ask for lump sum payments. Try not to go for higher than you need otherwise future you could have some serious regrets. Really, were all those new clothes worth it? Did you really need that takeaway? Yes and yes but future you might not be so understanding. I mean, the £100 incentive just to join HSBC is definitely appealing but it’s not exactly long term compared to other perks. If you’re an active person and like cycling, then the 12-month British Cycling Fan membership could be really good for you. You’ll get priority tickets to cycling events, exclusive discounts and insurance offers. Not too shabby.

5. Barclays Student Bank Account

The Barclays overdraft is one of the largest, alongside HSBC, which can be great if you need it. It’s just the fear of repayments after graduation that deter me, but if you’re responsible with money then it’s a decent option. They are also working with Campus Society for a limited time to offer 3 free e-textbooks. This would normally place the ranking a little higher after all, textbooks can be costly! The problem is this offer is for first year students only so if you’re thinking of swapping to or joining Barclay’s later at university, you won’t get enjoy this offer.

6 Halifax Student Bank Account

Halifax’s overdraft offer is relatively simple, you can get up to £1,500 for a maximum of 6 years. It’s a low overdraft offer and there are no exciting incentives, but the length of time is definitely handy if you plan to be at university for more than 3 years. Overall, not that exciting.

7. TSB Student Bank Account

In last place is TSB. The overdraft isn’t bad though it is a bit of a strange number however, again there are no incentives or perks. This is absolutely fine if you’re looking for a simple student account and you aren’t bothered by any extras but personally, I’m always looking for a freebie so it doesn’t make the cut!

So, what now?

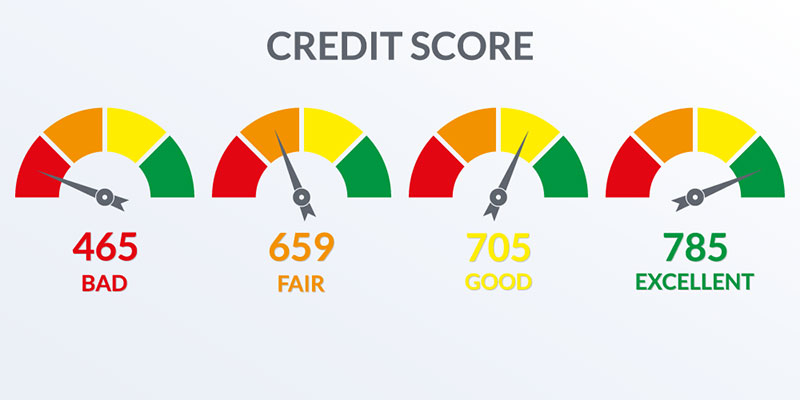

If you are worried about being accepted for a particular overdraft, I would recommend checking with the bank to see if they check scores. If they do, you can get a better understanding of where you stand if you take a look at your credit report. Both Experian and Clearscore are free, easy to understand websites that you can use to view your credit report and the factors impacting this.

Some banks will also expect you to regularly deposit money into your account so if you don’t have student loan or a regular income you could possibly be rejected altogether. Make sure you read the terms and conditions before applying. Ultimately the decision is up to you, but it’s good to do some research before you make your final choice. And don’t forget, you will need to update Student Finance otherwise you could delay your loan!

Cite This Work

To export a reference to this article please select a referencing stye below: